Niche LLMs: Tackling Infertility with AI

Mapping the startups driving innovation in IVF

Introduction

We’ve seen high failure rates driven by human error across many spaces in healthcare. In pathology, the human diagnostic error rate is 10%. In neurology, diagnostic misses or delays in acute stroke is 9%. Yet through deep learning algorithms, companies like PathAI and VizAI have dropped the pathology and stroke diagnostic error rate to 0.6% and 3.2% respectively.

So, why is IVF at a failure rate of 50%? Why hasn’t someone built a PathAI for reproductive endocrinology? These are questions that I have pondered as I’ve both invested in the space, and had close misses with friends on their fertility journeys.

One could argue that fertility as a category is too small to invest in for a venture outcome, and I’ll be frank: I don’t know the answer. My gut says that what often seems niche to start, becomes massive when cultivated. Stripe is a perfect example of this. When asked about their market size in the early days, co-founder Patrick Collison famously responded “My customers don’t exist yet.” Ecommerce was a new and upcoming category, and it was unclear if there would be enough ecommerce traffic to justify a multi-billion dollar outcome.

History often rhymes, and the tide waves occurring in IVF have familiar tones. IVF is growing in double-digits percentages YoY, families are overburdened by debt, data is siloed within clinics, providers are experiencing record levels of burnout, and millennials have purchasing power like never before.

Below are some insights from research, founders, providers and investors in interviews conducted over the last several months. As it turns out, AI might be a way to solve this ‘niche’ area in healthcare.

Background

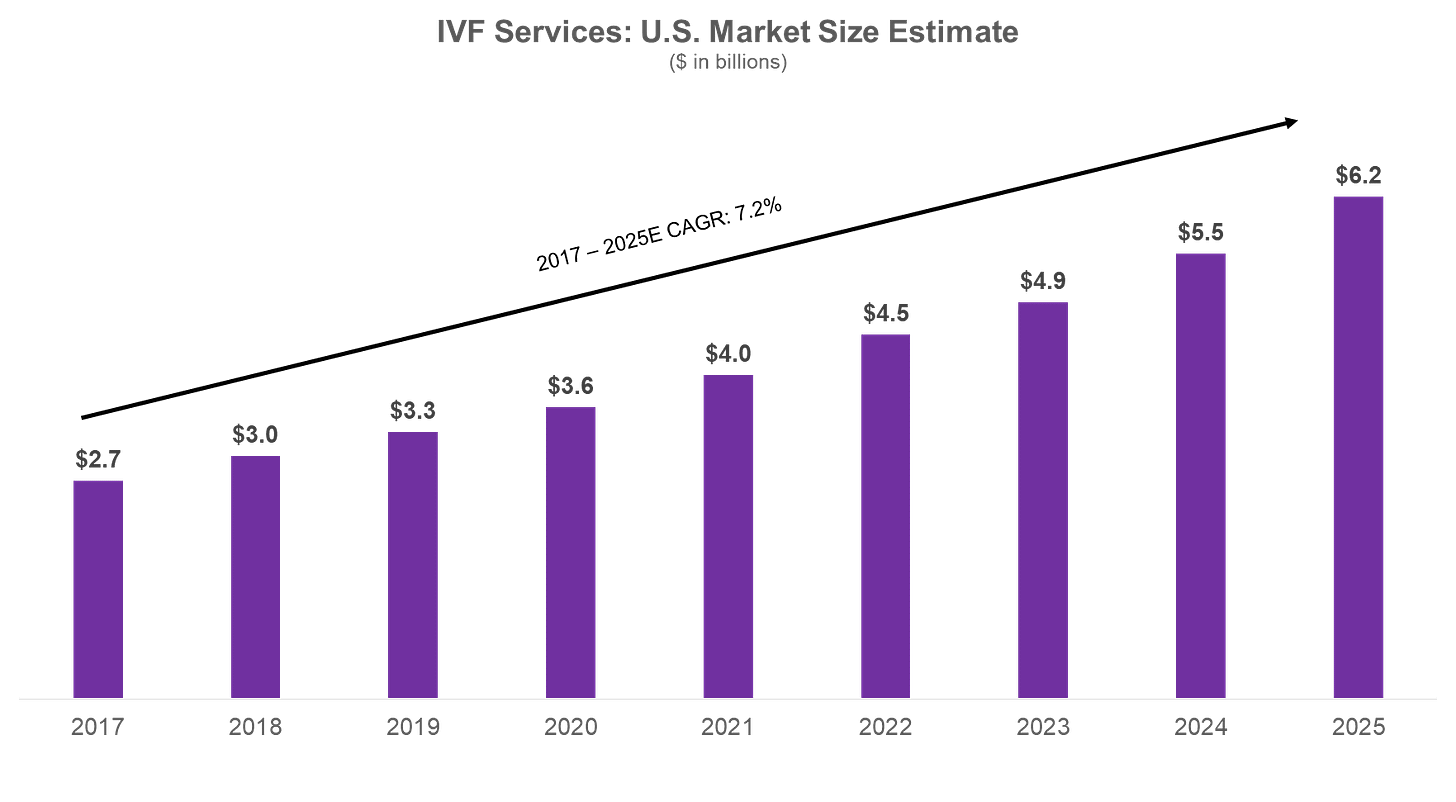

The first successful in-vitro fertilization was completed in 1978. While controversial at the time, the procedure proved that an egg could be safely fertilized outside of the uterus. Since then, IVF has become the standard for addressing infertility. The number of babies born through IVF has surpassed 10 million, representing 2% of all live births. The global IVF market is projected to reach $36 billion by 2026 ($6 billion in the U.S.), a 10% CAGR. In our last post, we discussed why this is the case – from women delaying childbirth to prioritize education and careers, to under-diagnosis of chronic conditions such as PCOS.

High Failure Rates

Despite its relative success and growth to a $6 billion industry here in the US, the IVF process has hardly improved in 50 years. Women under 35 have just a 55% chance at a live birth through one IVF cycle today. For women over 35, that number plummets to 40%.

Limited Clinics

There are families that cannot access IVF due to a limited number of clinics and embryologists. As of 2020, there were only 449 ART clinics in the US.

Besides age, success of IVF heavily depends on the expertise of the embryologist and the decisions made during the clinical process, with success rates dropping significantly at each stage.

Current Problem: The process for hopeful mothers is painful

Human Error

Stimulation: Ovarian stimulation, the first stage of IVF, is very subjective. Providers determine the right time and dosage for each patient to ensure quality egg production. As a result, about 5% of IVF cases result in ovarian hyper stimulation, a shockingly high number when algorithms elsewhere can predict optimal dosages and treatment protocols in fields like oncology and personalized medicine with much higher accuracy.

Fertilization: During fertilization, embryologists visually detect minute differences between good eggs and bad eggs. Not enough data has been aggregated to determine what causes the development of healthy embryos; for example, the right signals, genes, and proteins. So we see a shockingly high failure rate again: each egg has just a 70% chance of fertilization, and a 30% chance of failure.

Selection & Implantation: Lastly, successful embryo implantation hinges on a properly developed embryo, receptive endometrium, and precise placement. Embryo selection is up to the provider, based on characteristics such as size and symmetry. After selection, implantation requires a meticulous technique to place the embryo 1-2 centimeters from the fundus (i.e. the top) of the uterus. If improperly placed, the embryo will not develop into a pregnancy, resulting in a failed outcome.

Payment: Despite millions of hopeful parents going through this process, the majority of IVF is subjective, leading to preventable failed outcomes. On average, couples undergo 2 - 3 cycles of IVF before conceiving, with some requiring up to 6 cycles, and most families spend upwards of $60K for a successful outcome. About 30% of couples discontinue treatment, with cost cited as one of the primary reasons. IVF has thus ballooned into a $30 billion global industry.

Current Solutions

Over the last few years, a number of startups have emerged to tackle different parts of this problem stack.

Fertility v1.0

In what we’ll call “Fertility v1.0,” ~$1Bn of funding has been invested into companies like Kindbody, Maven, Progyny, and Carrot Fertility that provide integrated fertility services, usually as a benefit to employees. The thesis here is simple: help families plan, track, and manage their fertility journey in hopes of pursuing lower-cost, non-invasive services. Employers also benefit by retaining employees longer.

As technological costs have declined in compute power, and demand has surpassed supply in IVF, more companies are emerging at the technical layer to release bottlenecks in the IVF process. I call this “Fertility v2.0.” These are companies like Gameto, which is developing ovarian support cells to mature oocytes outside of the body, reducing the time from ~2 week ovarian stimulation to a few days. Or Fairtility, whose computer vision algorithms augment the embryo selection process and predict the likely effectiveness of implantations. Even at the extreme, Conceivable Life Sciences is building labs with advanced robotics to fully automate IVF.

Obstacles for Emerging Players: Building in fertility runs right into ethical and distribution barriers.

Regulatory & Ethical Barriers

Most startups have to go through rigorous FDA approval (e.g. Gameto is entering Phase III trials, and Alife is in clinical trials for analyzing embryos). Then there is the ethical consideration of utilizing automation in reproductive health. Conception, which has raised almost $40 million since its founding in 2018, is pursuing in-vitro gametogenesis. In other words, maturing the eggs in a lab, which according to the company would “give women the opportunity to have children well into their forties and fifties, eliminate barriers for couples suffering from infertility, and potentially allow male-male couples to have biological children.”

Another company, Orchid Health, allows hopeful families to sequence the whole genomes of embryos conceived by IVF. Families could theoretically screen out embryos that may develop a genetic disorder, leading one to wonder what deems a life worthy of implantation. Orchid drew backlash from the Psychiatric Genomics Consortium who claim the company inappropriately utilized their data; their goal “is to improve the lives of people with mental illness, not stop them from being born.”

Meanwhile, others argue that the funding being poured into IVF should be going into researching infertility, given women were not required to be included in government-funded clinical research until 1993.

Doctor Bottlenecks

“To democratize IVF offer a la carte options, divide cycles across multiple sites, and empower OBGYNs.”

- Abigail Sirus, Investor at AWM Investments/ Special Situations Funds

OBGYNs act as the gatekeepers to reproductive endocrinologists and embryologists, which are both extremely scarce. In fact there are only 40 new embryologists per year. Alife is one company directly addressing this problem, dividing cycles into 3+ sites and shifting testing and intake to OBGYNs. Alife directly integrates within physician workflows to optimize dosage and embryo grading. Still, there is more to be done.

But some might be hesitant to adopt new technology given more pressing needs. Board certified REI and OBGYN, Dr. Tina Jackson-Bey, highlighted that there’s even more low hanging fruit to improving the fertility process. Access to REIs (i.e. getting an appointment) is the number one issue she sees patients face. Her office administrators also have to try and determine insurance coverage, and financing options, leading to a massive bottleneck. On top of that, IVF involves mail-order delivery, which feels outdated in today’s tech-focused world. Comprehensive care from intake to discharge is crucial, she says.

“Everything touches our field. From our symbiotic relationship with OBGYNs who often serve as the gatekeepers to fertility services, to working with oncologists educating cancer patients about their options before treatment to partnering with therapists supporting patients’ mental health needs to nutritionists, reproductive urologists, pharmacists, geneticists and more … patients need comprehensive care.”

- Dr. Tia Jackson-Bey, Reproductive Endocrinologist and Infertility Specialist at Reproductive Medicine Associates of New York

Companies like Frame Fertility are attempting to bridge the gap between OBGYN and REIs for patients by leveraging tech / task lists to screen patients prior to their appointments, freeing up REIs to focus on the IVF process itself.

Mental Health Costs

Most tend to overlook the mental toll the process takes on mothers. Maternal mental health conditions drive more than $14 billion in healthcare costs, and 85% of women with postpartum depression do not receive treatment. Seven Starling (where I am an investor), is attempting to solve this problem.

The vast majority of funding has gone to family planning & virtual clinics, while IVF and Biotech / Life Sciences companies tackling fertility have received relatively little funding.

Data Collection Barriers & Final Thoughts

While there are only ~500 ART clinics in the United States, clinics lack standardized data formats. The data involves complex multi-dimensional time-series data from hormone monitoring, spatial data imaging, and extensive genetic information. Therein lies the volume and aggregation problem – one founder we talked to mentioned their company does not have enough proprietary data to generate quality LLMs. Another mentioned access to a high volume of data, but “awful” quality. Decisions are widely dispersed between countries, clinics and embryologists. Hence, most startups are building their own standardized database via existing patients and / or partnerships with medical centers to acquire ovary donations.

While this is the last section in this post, I find it to be the most intriguing pain point to solve today. If patients opted in, and clinics shared the multi-variable factors that led to a certain diagnosis and dosage, could LLMs solve not just for poor IVF outcomes, but also infertility itself? Instead of spending time where training datasets are wildly available, perhaps teams could focus on solving for this use case — where providers are overwhelmed, and patient journeys are mediocre at best, traumatic at worst. Similar to how there are thousands of images being created in pathology, there are thousands of images being produced during fertility journeys that could be used to diagnostically solve this problem.

Special thanks to Alliyah Gary and the many doctors, founders, & VCs who provided insights for this post.