“When I worked at Time Magazine, or when I was growing up, I knew a lot of smart people. It suddenly occurred to me, that smart people are a dime a dozen, and they don't usually amount to much. The real key was being creative…whether it's Leonardo da Vinci, or Ben Franklin, or Steve Jobs, these are people who loved to see patterns across nature. They were interested in everything you could possibly know. And by seeing those patterns, they made mental leaps that others didn't do. So I've never been interested in powerful people necessarily, or poets, or soldiers. I've been interested in creative thinkers.” – Walter Isaacson, Author

Backdrop

A change in consumer behavior typically happens following an external shock. Those that are big enough happen just once in a decade. Since 1950, the stock market has crashed by 20% or more only 12 times. That averages out to once every 5 to 6 years. In each decade, one crash usually corresponded to a financial silo (e.g. Black Monday), the other to a fundamental shift (e.g. the housing crisis). In this decade of the 2020s, two fundamental shifts are happening in quick succession - less than 2 years: how we work and how we spend. This is unprecedented.

We all know about the shift to remote work - less crowded trains, short lines for coffee, and distributed employees feel like the norm rather than a temporary blip. People are quitting their jobs at record rates as they reevaluate what matters in life. Perhaps money can’t by happiness, but health and purpose can.

Now, as we abruptly exit a low interest rate environment, what to spend money on will shift as well.

Why You Should Care

We can consult history to surmise how permanent spending shifts lead to ripple effects across businesses. Lest we forget that the ’08 crisis led Millennials to inherently question the American dream of owning a home. Trading in picket white fences for shared food, homes, cabs, and even shared ledgers. Hello Airbnb dream home. Hello Uber Black car. Hello Instagram followers and private jet in a mall pictures. Hello bitcoin.

Lest we forget the counter example – when a Fed hike preceded the ’87 flash crash (“Black Monday”) that became just that – a flash. The Dow Jones dropped 23%, the largest percentage drop in one day at that time. With Alan Greenspan at the helm, the Fed responded. Leveraging moral suasion, injecting liquidity into the market and providing a confidence boost to banks despite chaotic conditions.

When there’s a fundamental shift in how people spend, incumbent companies slow down R&D, and new companies arise in that void. We are reaching that moment right now.

Take note of the unprecedented circumstance we find ourselves in. Recessions are usually backward looking, caused by a financial shock - yet the word inflation squeezes into many Americans’ push notifications every morning; and recession probabilities seem to be forecast by Wall Street more frequently than COVID numbers. Meanwhile, the Fed is caught between two worse realities – a recession or a currency crisis – which hill do you die on?

Well, inflation boils down to reality + expectations. And the expectations of high inflation have overshadowed the reality of supply chain constraints that can, and should inevitably, be lifted. Over the past year, as many understandably became disillusioned by work in the face of sickness, they dove into savings. As of May ‘22, Americans only have 5% of disposable income in savings, the lowest since the housing crisis.

Source: U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PSAVERT, July 14, 2022.

It is likely that the Fed will die on the recession hill. They will bring down inflation expectations and continue to hike rates, or at least signal as much. Thus, we find ourselves in a place where consumer behavior is about to change, again. No matter how many doomsday presentations CEOs watch, or DCF models they run, companies will likely be left backpedaling to understand who they are serving, and what these users want.

My Prediction

The Fed will continue to raise rates and tamper heightened inflation expectations. We reach a recession, but it is brief. Median-income consumers will pull back spending on travel and experiences, but continue to care about who and what they work for more than a job with a lack of purpose, even if it pays more. Budgeting will become important again, smaller and more manageable homes with less maintenance will look attractive, and a renewed focus on health and wellness will grasp consumers who opt for closer connections instead of frivolous ones.

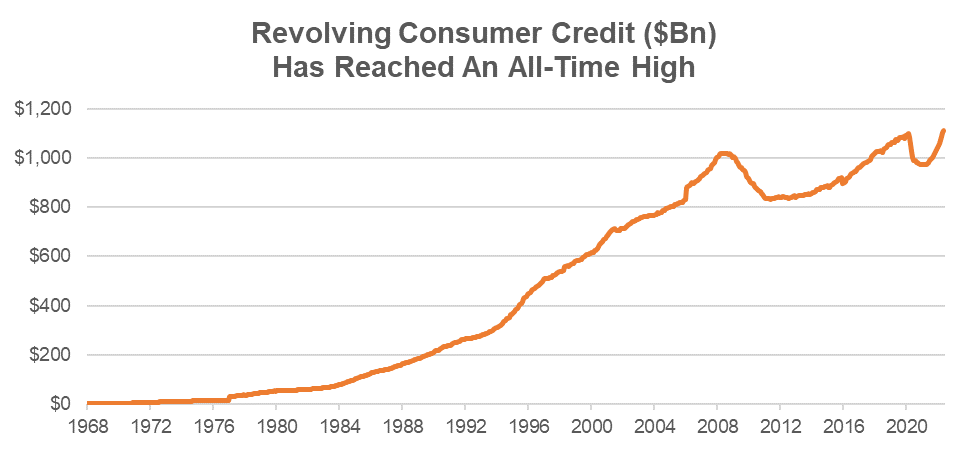

Source: Board of Governors of the Federal Reserve System (US), Revolving Consumer Credit Owned and Securitized [REVOLSL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/REVOLSL, July 14, 2022.

As they say, in change lies the greatest opportunity. Many people in tech are running to large companies with job security. A much needed respite in the face of layoffs and uncertainty. Many consumers will have to save to pay off credit card debt as revolving credit reaches an all time high. Yet this creates a dislocation – one where those who can take the leap of faith to start something new, have the advantage of starting fresh for the new consumer, and doing so without a lot of competition. These are not the smart people of the world – they are the creative people of the world – and they will drive the next decade.

Thanks for reading. More to come in the weeks ahead.

Disclaimer: The above is an opinion and for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.